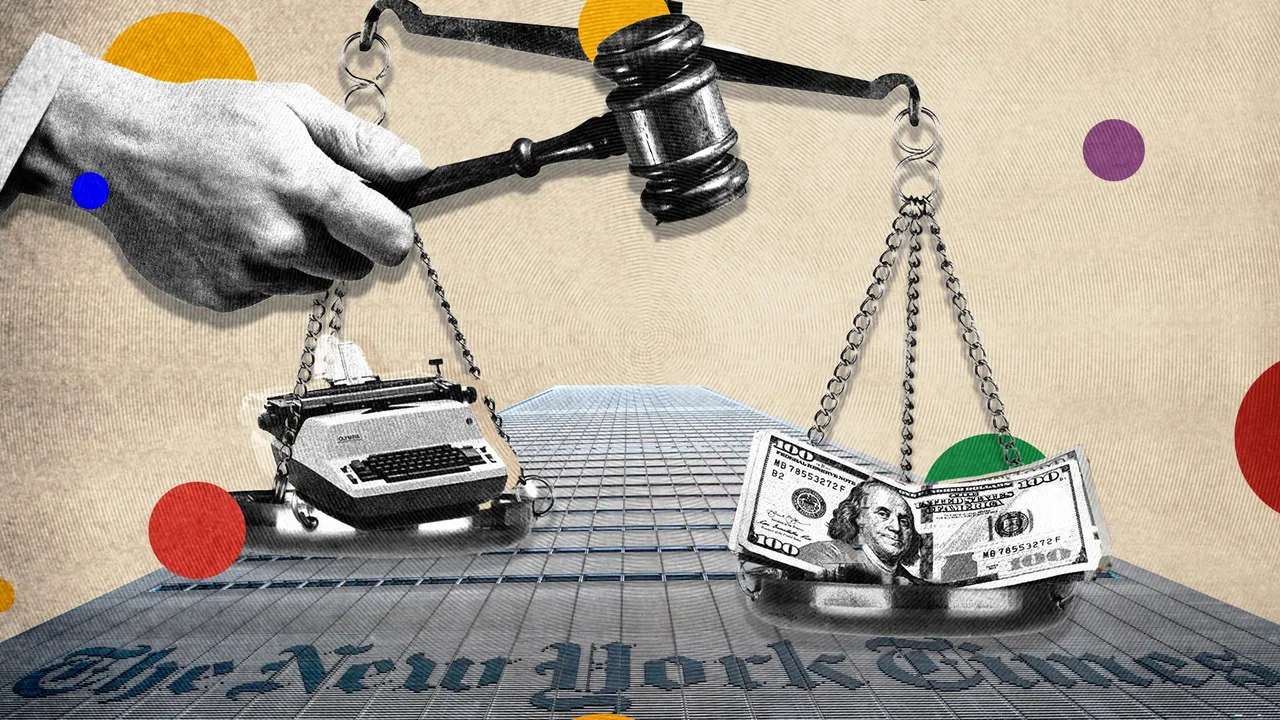

When it comes to securing financing for real estate projects, especially in the commercial sector, Kennedy Funding has been a name that frequently surfaces. However, like many companies in the financial sector, Kennedy Funding has found itself the subject of various ripoff reports and allegations over the years. This article provides a comprehensive examination of these claims, exploring their origins, validity, and what they mean for potential clients considering working with the Kennedy Funding Ripoff Report.

Who is Kennedy Funding?

Kennedy Funding is a direct private lender specializing in hard money loans for commercial real estate projects. Founded several decades ago, the company has built a reputation for providing fast and flexible financing solutions, particularly for borrowers who might struggle to secure traditional bank loans. They advertise their willingness to fund projects others may deem too risky, including:

- Land acquisition

- Development projects

- Bridge loans

- Bank workouts

Their ability to work with international clients and finance deals in as little as five days has made them a popular choice for developers under time constraints.

The Basis of Ripoff Reports

Despite their established reputation, Kennedy Funding Ripoff Report has faced allegations ranging from misrepresentation to unethical practices. Many of these complaints have been filed on consumer advocacy websites such as Ripoff Report and Better Business Bureau (BBB). Below, we outline the key issues raised:

- High Fees and Costs

- Some borrowers claim that Kennedy Funding charges exorbitant fees upfront. These include application fees, legal fees, and other ancillary charges, which are non-refundable regardless of whether the loan is ultimately approved.

- Unclear Loan Terms

- Critics argue that Kennedy Funding’s loan terms are not always transparent. Borrowers have alleged that key details about interest rates, repayment schedules, and penalties are only disclosed late in the process, leaving them in a difficult financial position.

- Loan Rejections After Upfront Payments

- One of the most common complaints is that Kennedy Funding collects significant upfront fees only to reject the loan application later. Borrowers claim this practice leaves them out-of-pocket with no recourse for reimbursement.

- Poor Communication

- Some reports cite a lack of responsiveness from the company’s representatives, particularly when disputes arise. Borrowers have expressed frustration with delayed responses or vague explanations.

- Aggressive Collection Tactics

- A minority of complaints revolve around aggressive collection efforts, including legal threats, when borrowers encounter difficulties meeting repayment obligations.

Evaluating the Complaints

While ripoff reports can be alarming, it’s essential to approach these claims critically. Here are some factors to consider:

- Nature of the Industry

- The hard money lending industry is inherently high-risk. Borrowers who turn to private lenders often have credit issues or are pursuing speculative projects. This risk profile can lead to misunderstandings or unmet expectations.

- Due Diligence

- Some complaints appear to stem from borrowers not fully understanding the terms of their loans. This highlights the importance of thoroughly reviewing all documentation and seeking legal advice before committing to a deal.

- Competitive Practices

- In some cases, negative reviews may be posted by competitors or individuals with personal grievances. It’s not uncommon for companies in competitive sectors to face unfounded allegations.

- Resolution Rates

- Kennedy Funding has resolved many complaints, as evidenced by their responses on platforms like the BBB. This suggests a willingness to address issues, even if they arise from misunderstandings.

Best Practices for Borrowers

If you’re considering working with Kennedy Funding Ripoff Report or any private lender, taking the following steps can help protect your interests:

- Conduct Thorough Research

- Read reviews, analyze ripoff reports, and verify the lender’s track record. Seek out testimonials from borrowers with similar projects.

- Understand the Terms

- Request all loan terms in writing before signing any agreements. Pay close attention to fees, interest rates, and repayment schedules.

- Consult Professionals

- Work with a real estate attorney or financial advisor to review the loan agreement. This ensures you understand the potential risks and benefits.

- Beware of Upfront Fees

- While application and legal fees are standard in the industry, excessive upfront costs should raise a red flag. Ask for a clear breakdown of these charges.

- Maintain Clear Communication

- Document all interactions with the lender and keep records of emails, contracts, and payment receipts. This can be invaluable if disputes arise.

Kennedy Funding’s Response to Criticism

Kennedy Funding has addressed many of the allegations made against them, often emphasizing their commitment to transparency and customer satisfaction. They argue that:

- High Fees Reflect Risk: The fees charged are proportional to the risks associated with their lending model. Borrowers with poor credit or unconventional projects represent a greater risk.

- Rejected Loans are Rare: Most loans are rejected during the preliminary review stage, before significant fees are collected.

- Communication Improvements: The company has implemented measures to improve customer service and ensure clearer communication.

Conclusion:

Kennedy Funding ripoff reports are a reminder of the importance of due diligence when seeking financing. While the company has faced criticism, many of the issues raised are common in the hard money lending industry. Borrowers should approach these loans with caution, ensuring they understand all terms and risks involved.

For those who take the time to research and prepare, Kennedy Funding can provide a valuable resource for securing financing that traditional lenders may not offer. Ultimately, a successful partnership depends on clear communication, mutual understanding, and realistic expectations from both parties.